How Insurance Works

Health insurance is one of the best ways you can protect yourself and your family in case you get sick or injured and need medical care. It also helps you get the regular medical and dental care you need to stay healthy.

In this article:

Key points

- Health insurance helps pay for medical care

Health insurance is a plan that helps pay for doctor visits, hospital stays, and medicines. You pay a monthly fee (premium) and sometimes small payments (copays) when you get care. Some people get insurance from their jobs, and others can buy it from the Health Insurance Marketplace. Programs like Medicaid, Medicare, and CHIP help certain groups, like low-income families, seniors, and children. - The Affordable Care Act (ACA) improved health insurance

The ACA made health insurance better for everyone. Now, insurance companies can’t refuse to cover people with health problems. Young adults can stay on their parent’s insurance until age 26. Insurance must also cover important health services like check-ups, emergency care, and prescriptions. Preventive care, like vaccines and screenings, is free. - Choosing and using health insurance is important

Different health plans have different costs and rules. Some plans let you pick any doctor, while others only cover certain doctors. When choosing a plan, people need to think about costs like premiums, deductibles (what you pay before insurance helps), and co-insurance (your share of costs). It's important to pay your bill on time and choose doctors in your plan’s network to save money.

What is health insurance?

Health insurance is a signed contract with a health insurance company. This contract requires the company to pay for some of your health care costs. That doesn’t mean they will pay for everything. You will still have a responsibility to pay some costs.This can include your monthly premiums and your copays when you visit the doctor.

Now you can buy health insurance through the Health Insurance Marketplace. The Health Insurance Marketplace (also called Health Exchanges in some states) is a new way to help you find and buy insurance. The insurance covers more of your medical needs and may be more affordable. It offers different plans to choose from depending on what medical care you’ll need. You might also qualify for tax credits from the government. This can help make your health insurance even less expensive.

People with health insurance are better able to take care of their health. They can afford regular check-ups so little health problems don’t turn into big ones. With health insurance you don’t have to go to crowded community clinics, or wait a long time for medical care. You can get better and faster care to help you stay healthier.

Health insurance programs

- There are different types of programs that people can be eligible for. Many people receive health insurance through their job as a benefit. They may pay a small cost each month for their insurance, or no cost at all, depending on the company they work for. Other people receive Medicaid, which is insurance from the state.

- There are also other health insurance programs for specific groups. Some examples of this are Medicare, which is for seniors age 65 or older, or the Children’s Health Insurance Program (CHIP), which is for children. These programs have special requirements.

- People who don’t get insurance through their job, Medicaid, Medicare or CHIP have to buy it on their own. It used to be very expensive, and sometimes it didn’t pay for enough care. But some positive changes have been made to ensure more people have the care they need.

Thanks to the Affordable Care Act (ACA), millions of people can now afford health insurance. The ACA also rules that everyone in the United States must have health insurance. If you don’t buy health insurance, you may have to pay extra in your taxes as a penalty.

The ACA changed how health insurance works. Some of the changes are:

- Parents can keep their children on their health insurance plans until they turn 26 years old.

- Insurance companies cannot turn down people who already have medical conditions. These are sometimes called “pre-existing conditions.” Before, a company could decide not to insure someone because they had a medical condition like diabetes, or because they had cancer in the past. Now, everyone must be accepted.

- Insurance companies cannot cancel people’s insurance plans if they get sick.

- Insurance companies cannot set a limit on how many medical bills they will pay for someone on their insurance plan.

- Preventive care is now free. Your insurance cannot charge you for doctor visits for babies, vaccinations, annual check-ups, screenings and other care that helps you stay healthy.

- You can buy your insurance in the Health Insurance Marketplace (Marketplace). Before, if your job didn’t give you health insurance, you had to buy it on your own and it was usually very expensive.

- Health insurance plans now have to cover a certain amount of care. Before, each company made their own decisions about what they would pay for and to what amount.

The ACA also makes sure that all health insurance plans offer the following benefits, known as essential health benefits. Essential health benefits include:

- care you get without being admitted to a hospital (known as ambulatory patient services)

- emergency room care

- hospital care

- pregnancy and newborn care

- mental health and substance use care

- prescription drugs

- rehabilitative and habilitative services and devices

- laboratory services

- preventive and wellness services and chronic disease management

- pediatric services, including oral and vision care

Preventive care

Preventive care means care that helps you stay healthy. These are services that prevent or help you from getting sick. ACA has a rule that states health insurance must now always include free preventive care.

A good example of preventive care is vaccinations. When you get a flu shot during flu season, that means you will not get the flu, or you will be less sick if you do get it. Because vaccinations are preventive care, your health insurance will pay 100% of the cost.

Other types of preventive care are:

- Screenings: Checking to see if people have high blood pressure, depression, or other medical issues that might cause serious health problems. If these are caught early, treatment is easier and may work better.

- Children's Health: Health services for children can include: checking for autism, checking hearing in newborn babies and vision in children as they grow older, and giving them vaccinations.

- Women's Health: Health services for women and people assigned female. This includes mammograms, checking for cervical cancer, and providing birth control.

- Men's Health: Health services for men such as colon cancer screenings and screenings for use of aspirin to prevent heart disease.

Types of health insurance plans

When you choose an HMO or EPO insurance plan, your insurance will only pay for providers if they are part of your insurance plan's network. If you want to use a different doctor or hospital, you will have to pay for it yourself. HMOs also usually make you get a referral from your main doctor to see a specialist like an endocrinologist or therapist. But EPOs usually do not.

With these plans, you can choose any doctor or hospital. If you pick ones that are part of the insurance plan's network, it will cost less.With PPO plans, you can visit any doctor without getting a referral. If you have a POS plan, you can visit any doctor within the plan without a referral. But doctors outside the plan do need a referral.

HDHPs usually have low premiums and high deductibles compared to other plans. With an HDHP, you can use a health savings account or a health reimbursement arrangement to pay for some medical costs. This means that your employer takes some of your paycheck and puts it into a special savings account. When you need money for medical care, you can take it from that account.

People under age 30 or who have hardship exemptions may be able to buy a "catastrophic" plan. This plan mainly protects you from very high medical costs in the case of a major injury, such as from a car accident. The monthly premiums are low but the deductibles are high.

Applying for insurance

The Marketplace helps people buy health insurance and find out if they can qualify for tax benefits, also known as subsidies, that will make health insurance less expensive.

You can apply for health insurance through the Marketplace on your own, either on the phone or on the internet. Because applying for insurance can sometimes be confusing, there are people who are trained to help you.

Navigators or Certified Application Counselors (CACs), work with the Marketplace to help you understand your choices. They can help you figure out what the costs will be, based on how much money you earn and how many people are in your family. They can also answer your questions about how health insurance works and how it can help you.

The application for health insurance through the Marketplace will ask you about:

- how much money you earn

- how many people are in your family

- where you live

- what expenses you have

- and more

This will help you figure out how much you can afford to pay for health insurance. It can also help you determine if you’re eligible for tax credits to make your insurance cost less. Your Navigator or CAC can tell you about the documents to bring to your meeting, such as pay stubs from your job, your tax return, or immigration documents. It takes about one hour to fill out the application with the help of the Navigator or CAC.

Paying for Your Health Insurance

Remember that health insurance is a contract that you sign with the health insurance company. Signing up for health insurance is the first step. Your next step is paying for it.

You will need to pay an insurance bill each month to keep your insurance. Health insurance should now be part of your monthly budget. Just like you pay rent and utilities, you must also pay for your health insurance, or it will be cancelled. If this happens and you need to see a doctor or get other medical care, you will have to pay the entire amount yourself.

You will receive your first bill a few days after you sign up for health insurance through the Marketplace. This will come from your new insurance company and it will tell you how much to pay. This amount should be the same as the amount you agreed to when you signed up.

If you have questions about your insurance in the future, like how much things will cost or who your doctor will be, call your insurance company, not the Marketplace. Don’t be afraid to ask for help from a Navigator, CAC, or your insurance company.

How to use health insurance

Now that you have health insurance, you are able to get the health care you need, when you need it. You won’t have to wait until your medical issues are really serious to seek treatment.

You can pick a medical provider you like who is located in a place that’s convenient for you, and build a relationship with them that helps you take charge of your health. Your health is now in your hands.

This booklet explains how to get started using your health insurance. If you have more questions, remember that you can always call your health insurance company or your medical provider directly.

Good health means that you take care of your body and mind by exercising, eating right and taking time to relax. When you are healthy, you are more able to do things you enjoy. You feel good, and that helps your mood and your relationships.

An important part of staying healthy is getting regular check-ups. At check- ups, your doctor will make sure that your heart, lungs and the rest of your body are in good shape.

Check-ups are a way to catch medical problems before they get worse. They also help manage medical problems you may already have. Check-ups are a good time for you to ask questions about both your mental health—how you are dealing with your emotions—and your physical health—how your body feels.

Every health insurance plan is different. It’s important to check your insurance plan to see what services it covers. You can also review your “Summary of Benefits”. This provides you with written information about your plan’s costs and benefits. If you have questions about your plan or benefits, you can call your insurance company. You can also use the form at the end of this booklet to write down some helpful information about your insurance plan and doctors.

A primary care physician is your main doctor. They take care of your general health. They may also refer you to specialists for help with specific illnesses.

A specialist is a medical provider with extra training in a specific type of medical condition. For example, a cardiologist is trained in heart health. A psychologist is trained to evaluate and treat mental and emotional issues. Make sure you understand the process for seeing a specialist under your plan. Sometimes you can only see specialists after you see your main doctor.

Many health insurance plans offer extra programs at little or no cost. These programs include things like weight loss groups or support groups for anxiety or depression. You can sign up for these on your health insurance plan’s website, by calling the insurance company, or by asking your doctor for information.

If you have major life changes, such as losing a job, getting a better-paying job, or having a baby, these events can change the amount you need to pay for health insurance. Keep your insurance company up to date about big life changes so you don’t pay more than you should.

Find a health care provider

Providers can be any person or place that provides you with health care. This can include doctors, specialists, therapists, hospitals, and clinics. If you don’t already have a health care provider, or if your current provider is not part of your new insurance plan, how do you find one?

- Ask people you trust: Ask your friends and family about who their doctors are.

- Check your plan's provider network: Your insurance company should have a list of providers they work with. Sometimes this information is available on the insurance company’s website. You can also contact the insurance company’s member services office and describe the kind of provider you want.

- A good fit matters: Contact your plan if you want to change providers. You can request another provider without even seeing the one assigned to you, or even after you’ve seen the provider many times. It’s your health, your body, and your right to see a provider who makes you feel comfortable.

- Find a match: Think about what you want and need from a provider. You may want to look for providers who are close to your home or work, and whose office hours are convenient for you. Ask if the provider, or someone in their office, speaks your language. Find out what hospital the provider works with.

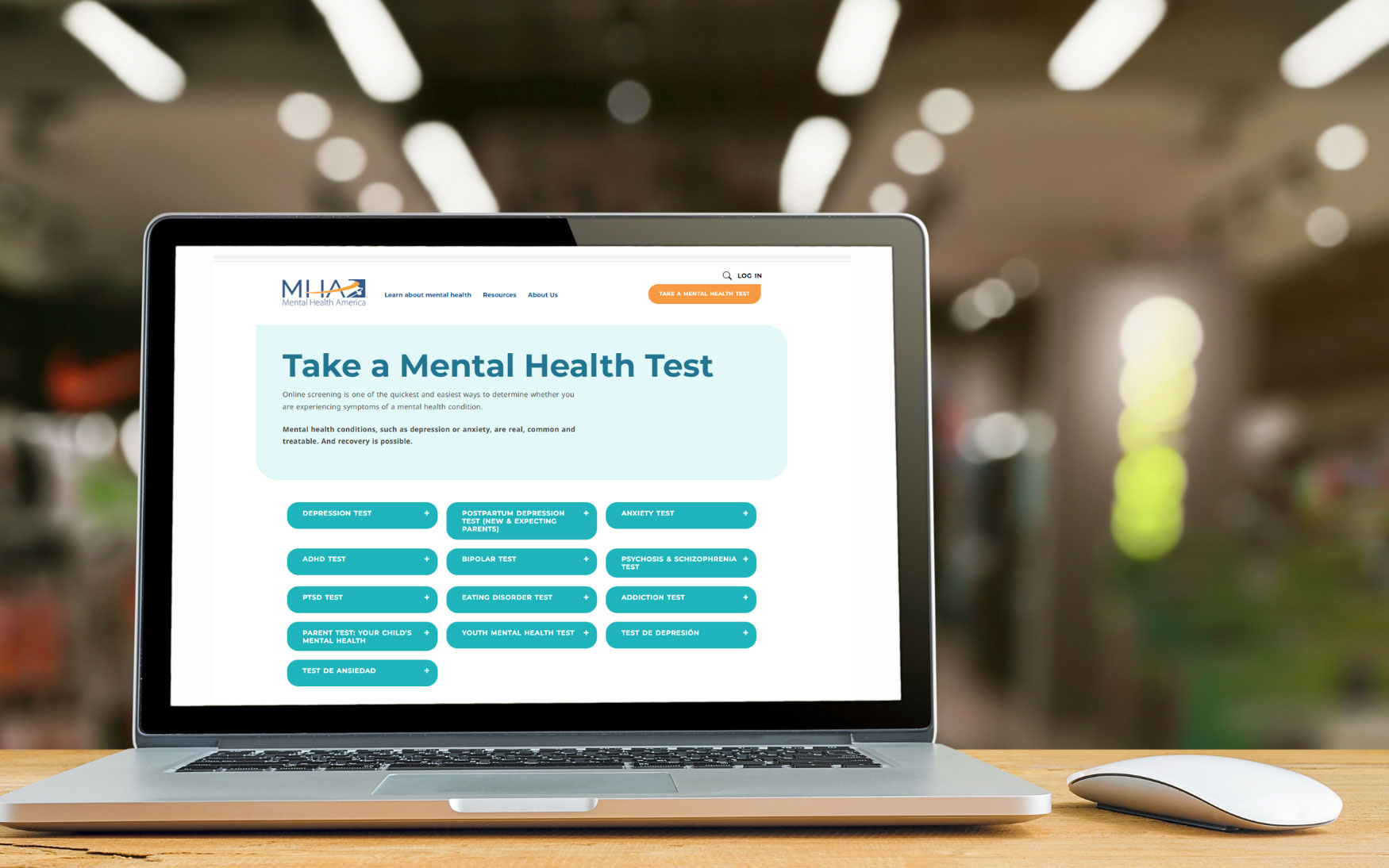

Take a Mental Health Test

If you or a friend are struggling with your mental health, take an anonymous, free, and private mental health test. It only takes a few minutes, and after you are finished you will be given information about the next steps you can take based on the results.